Cost of Goods Sold: How to Calculate with Formula — Katana

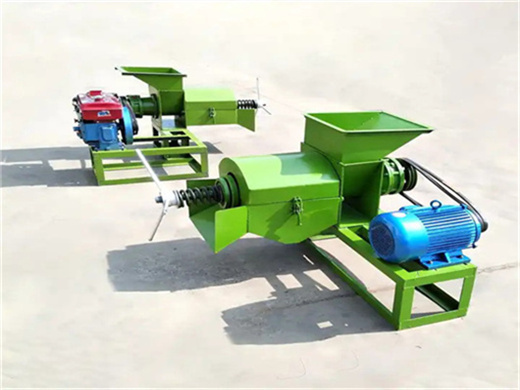

- Type: soybean oil processing machine

- Usage/Application: soybean

- Production capacity: 10-100TPH

- Voltage: 220V/380V/440V

- Weight: According to cooking oil processing capacity

- Dimension (L*W) *H): 1200*400*900mm3

- Power (W) : 10-50kw

- Country: uganda

You purchase the necessary equipment, raw materials, and supplies. In order to calculate COGS, you need to know the value of raw materials that goes into one unit. Let’s go over the raw materials cost and how it relates to COGS. The raw materials are: Wax; Fragrance oil; A wick; A glass jar; A warning label; A brand label

How to Calculate COGS for a Manufacturer - YouTube

- Type: soybean oil processing machine

- Production capacity: 5t/day-5t/hour

- Voltage: 380V/customized

- Oil type: cooking oil

- Components main: motor, others, gears, bearings, gearbox

- Weight: 10000 KG

This video shows an example of how to calculate Cost of Goods Sold for a manufacturer. Manufacturers cannot calculate Cost of Goods in the same way that a r...

Having in place accurate inventory counting and adhering to a strict COGS calculation can help determine which products may be priced too low or too high. This allows a company to set appropriate pricing. Proper taxation. Since COGS is considered an expense, a larger COGS will result in a lower taxable income level.

3 Ways to Calculate COGS - wikiHow Life

- Usage: soybean oil

- Production capacity: 98%

- Voltage: 220 V

- Key selling points: High productivity

- Weight: 22KG, 22kg

- Dimension (length x width x height): 50*53*30 cm

Calculate COGS. Subtract the quantities sold from your inventory beginning with the earliest date. Then multiply them by the purchase cost. Your COGS would be 10 x $1 = $10 plus 5 x $1.50 = $7.50 for a total of $17.50. Your COGS is lower under the FIFO reporting method and your profit is higher when inventory costs are rising.

Businesses rely on the COGS calculator to set product prices, evaluate profitability, and prepare accurate tax filings. It simplifies the process of assessing inventory usage and costs associated with the sale of goods. Formula of Cost of Goods Sold Calculator. The formula for calculating the Cost of Goods Sold (COGS) is:

Cost of Goods Sold (COGS): How To Calculate - SoFi

- Type: cooking oil extraction machine

- Production capacity: 30-100 tons of oil per day

- Power ( W): Capacity

- Voltage: Adjustable

- Dimension(L*W*H): According to machine

- Weight: According to machine

How To Calculate COGS. Calculating COGS can be useful as part of a break-even analysis, and you can reassess the figures monthly or quarterly to track the company’s progress. The following formula shows how to calculate the cost of goods sold. COGS Formula and Example Calculation. The COGS formula is:

How to Calculate Cost of Goods Sold – The Formula. You can apply the following formula to calculate the cost of goods sold: COGS = beginning inventory + purchases – ending inventory. Let’s take a quick look at the components of COGS: Beginning inventory: this is the company’s inventory from the previous period.

How to Determine Cost of Goods Sold (COGS) and Reduce

- Raw Material: soybean

- Material: carbon steel or stainless steel

- Packaging: according to customer's requirement

- Capacity: 5-600T/D crude oil plant

- Raw material: crude oil (CPO)

- Operation: easy operation and energy saving

Implementing waste reduction measures throughout the production process can significantly impact COGS. Example: A food processing company could implement measures to reduce food waste during production, such as optimizing portion control and improving storage practices. 6. Control Labor Costs

How to Calculate COGS in 6 Steps Step 1: Determine Direct and Indirect Costs. Calculating the goods sold (COGS) starts from determining your product or service’s direct and indirect costs. There are two types of cost included in COGS: direct cost and indirect cost.